Learn about the tokenomics of the BAX token that powers the L1 ReDeFi blockchain.

We publicly shared our excitement with you a few months ago and announced ReDeFi to the world.

ReDeFi is a financial market infrastructure (FMI) platform developed by BABB Group Ltd. It aims to revolutionise the current financial market infrastructure through blockchain technology, to create a regulation-friendly and efficient environment that transcends traditional finance barriers, offering fast, secure, and cost-effective solutions.

- ReDeFi is a public, permissionless Layer-1 blockchain that provides a secure, scalable, and cost-effective foundation for decentralised applications. With EVM compatibility, developers can easily build and deploy innovative solutions on a robust platform powered by the $BAX token.

BABB Group launched the $BAX token back in 2018 and in our first ICO campaign, we raised 18,000 ETH from over 10,000 investors from 130 different countries, to empower BABB’s mission for financial inclusion.

We had many ups and downs, but we stood strong during two bear markets, and a global pandemic where we assisted those who needed it most. Fast forward to today, and BABB’s journey continues through ReDeFi.

We tackle the existing financial hurdles – expensive cross-border transactions, B2B transfers, hidden fees by middlemen and so on – through our flagship product, Onchain Money. This idea augured the genesis of ReDeFi to improve the current monetary system, not change it.

Today, we are equally excited to share the final design of BAX’s tokenomics with the anticipation of our L1 mainnet.

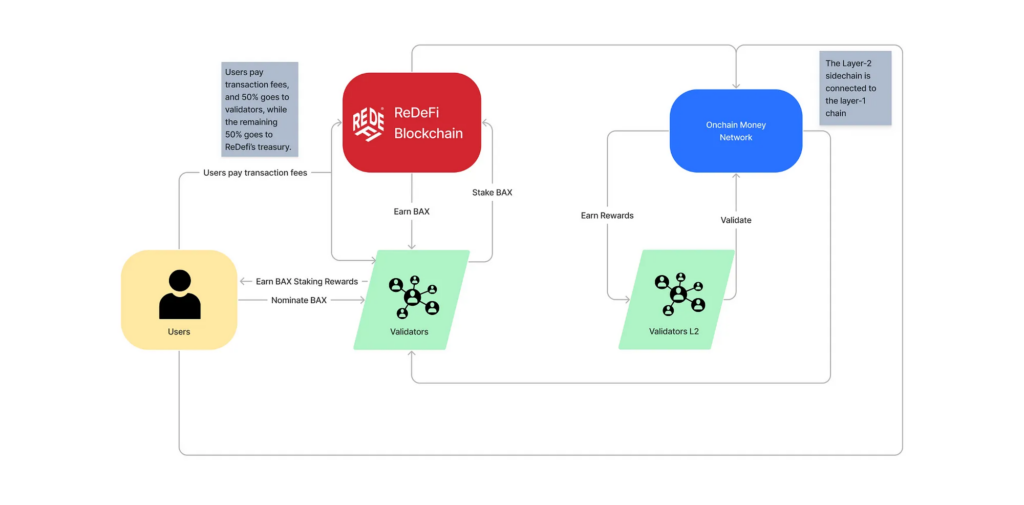

We aim to implement an economic system that aligns incentives across $BAX users, validators and every ReDeFi network participant.

$BAX Economy

$BAX maintains all its previous utilities within BABB’s ecosystem and will also be the main token of the ReDeFi L1 blockchain.

- The total supply of $BAX is: 100,000,000,000 (100 billion).

- Staking $BAX contributes to the security of the ReDefi blockchain.

- $BAX is used to pay for transaction fees on the blockchain.

While our network grows, the following will too. In the beginning, there will be 2 different sets of participants:

- Users, that submit transactions to the ReDeFi blockchain to create, mutate, and transfer assets or interact with native dApps enabled by smart contracts.

- Validators, initially managed by the core team, are responsible for managing all transaction processing and execution on the ReDeFi blockchain.

Value Accrual

- Ecosystem Fees: 50% of the fees generated by the network, will flow to the treasury to support the longevity and continuous development of the ecosystem.

- Revenue Redistribution: 50% of the generated fees will be distributed back to nominators (delegators) and validators.

In the graph below you can see a visual representation of how the system will work:

About BABB and ReDeFi

ReDeFi is a Financial Market Infrastructure (FMI) platform that integrates blockchain technology with traditional financial systems. It prioritises empowering various businesses and banks through a decentralised framework conducive to various financial operations, from cross-border B2B transactions to e-commerce and boosting government fiscal procedures. With the Onchain Money model, ReDeFi maintains the singleness of money principle, while expanding the ‘financial inclusivity’ and ‘banking the unbanked’ vision of BABB.

Risk Disclaimer:

Don’t invest in cryptocurrencies unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.